Sample Transaction #4

The fourth transaction occurs on December 3, when a customer gives Direct Delivery a check for $10 to deliver two parcels on that day. Because of double entry, we know there must be a minimum of two accounts involved—one of the accounts must be debited, and one of the accounts must be credited.

Because Direct Delivery received $10, it must debit the account Cash. It must also credit a second account for $10. The second account will be Service Revenues, an income statement account. The reason Service Revenues is credited is because Direct Delivery must report that it earned $10 (not because it received $10). Recording revenues when they are earned results from a basic accounting principle known as the revenue recognition principle. The following tip reflects that principle.

Here's a Tip

Revenues accounts are credited when the company earns a fee (or sells merchandise) regardless of whether cash is received at the time.

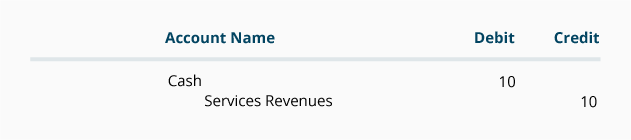

Here are the two parts of the transaction as they would look in the general journal format:

Sample Transaction #5

Let's assume that on December 3 the company gets its second customer-a local company that needs to have 50 parcels delivered immediately. Joe's price of $250 is very appealing, so Joe's company is hired to deliver the parcels. The customer tells Joe to submit an invoice for the $250, and they will pay it within seven days.

Joe delivers the 50 parcels on December 3 as agreed, meaning that on December 3 Direct Delivery has earned$250. Hence the $250 is reported as revenues on December 3, even though the company did not receive any cash on that day. The effort needed to complete the job was done on December 3. (Depositing the check for $250 in the bank when it arrives seven days later is not considered to take any effort.)

Let's identify the two accounts involved and determine which needs a debit and which needs a credit.

Because Direct Delivery has earned the fees, one account will be a revenues account, such as Service Revenues. (If you refer back to the last TIP, you will read that revenue accounts—such as Service Revenues—are usually credited, meaning the second account will need to be debited.)

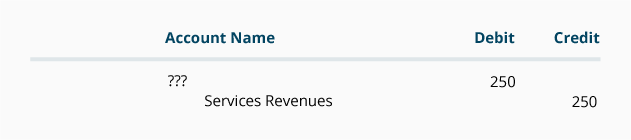

In the general journal format, here's what we have identified so far:

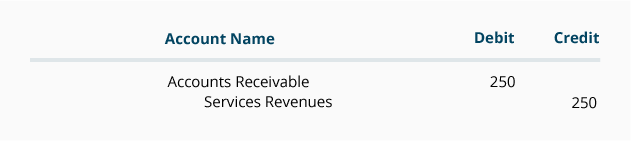

We know that the unnamed account cannot be Cash because the company did not receive money on December 3. However, the company has earned the right to receive the money in seven days. The account title for the money that Direct Delivery has a right to receive for having provided the service is Accounts Receivable (an asset account).

Again, reporting revenues when they are earned results from the basic accounting principle known as the revenue recognition principle.

Sample Transaction #6

For simplicity, let's assume that the only expense incurred by Direct Delivery so far was a fee to a temporary help agency for a person to help Joe deliver parcels on December 3. The temp agency fee is $80 and is due by December 12.

If a company does not pay cash immediately, you cannot credit Cash. But because the company owes someone the money for its purchase, we say it has an obligation or liability to pay. Most accounts involved with obligations have the word "payable" in their name, and one of the most frequently used accounts is Accounts Payable. Also keep in mind that expenses are almost always debited.

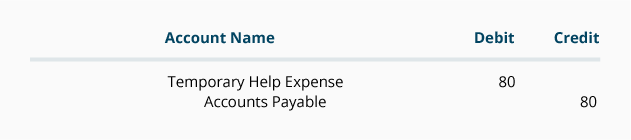

The accounts and amounts for the temporary help are:

Here's a Tip

Expenses are (almost) always debited.

Here's a Tip

If a company does not pay cash right away for an expense or for an asset, you cannot credit Cash. Because the company owes someone the money for its purchase, we say it has an obligation or liability to pay. The most likely liability account involved in business obligations is Accounts Payable.

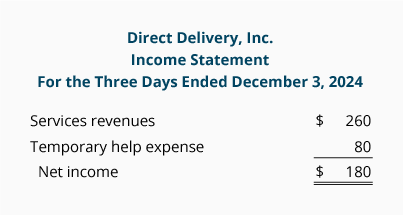

Revenues and expenses appear on the income statement as shown below:

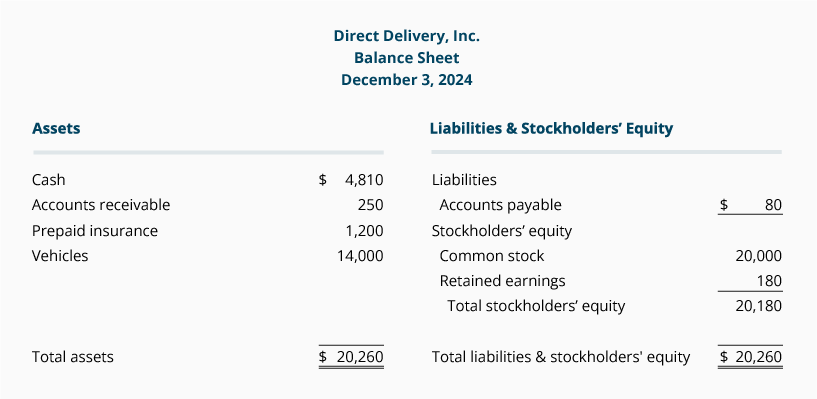

After the entries through December 3 have been recorded, the balance sheet will look like this:

Notice that the year-to-date net income (bottom line of the income statement) increased Stockholders' Equity by the same amount, $180. This connection between the income statement and balance sheet is important. For one, it keeps the balance sheet and the accounting equation in balance. Secondly, it demonstrates that revenues will cause the stockholders' equity to increase and expenses will cause stockholders' equity to decrease. After the end of the year financial statements are prepared, you will see that the income statement accounts (revenue accounts and expense accounts) will be closed or zeroed out and their balances will be transferred into the Retained Earnings account. This will mean the revenue and expense accounts will start the new year with zero balances—allowing the company "to keep score" for the new year.

Marilyn suggested that perhaps this introduction was enough material for their first meeting. She wrote out the following notes, summarizing for Joe the important points of their discussion:

- When a company pays cash for something, the company will credit Cash and will have to debit a second account. Assuming that a company prepares monthly financial statements—

- If the amount is used up or will expire in the current month, the account to be debited will be an expense account. (Advertising Expense, Rent Expense, Wages Expense are three examples.)

- If the amount is not used up or does not expire in the current month, the account to be debited will be an asset account. (Examples are Prepaid Insurance, Supplies, Prepaid Rent, Prepaid Advertising, Prepaid Association Dues, Land, Buildings, and Equipment.)

- If the amount reduces a company's obligations, the account to be debited will be a liability account. (Examples include Accounts Payable, Notes Payable, Wages Payable, and Interest Payable.)

- When a company receives cash, the company will debit Cash and will have to credit another account. Assuming that a company will prepare monthly financial statements—

- If the amount received is from a cash sale, or for a service that has just been performed but has not yet been recorded, the account to be credited is a revenue account such as Service Revenues or Fees Earned.

- If the amount received is an advance payment for a service that has not yet been performed or earned, the account to be credited is Unearned Revenue.

- If the amount received is a payment from a customer for a sale or service delivered earlier and has already been recorded as revenue, the account to be credited is Accounts Receivable.

- If the amount received is the proceeds from the company signing a promissory note, the account to be credited is Notes Payable.

- If the amount received is an investment of additional money by the owner of the corporation, a stockholders' equity account such as Common Stock is credited.

Note: To learn more about debits and credits, go to Explanation of Debits and Credits and Quiz for Debits and Credits. - Revenues are recorded as Service Revenues or Sales when the service or sale has been performed, notwhen the cash is received. This reflects the basic accounting principle known as the revenue recognition principle.

- Expenses are matched with revenues or with the period of time shown in the heading of the income statement, not in the period when the expenses were paid. This reflects the basic accounting principle known as the matching principle.

- The financial statements also reflect the basic accounting principle known as the cost principle. This means assets are shown on the balance sheet at their original cost or less and not at their current value. The income statement expenses also reflect the cost principle. For example, the depreciation expense is based on the original cost of the asset being depreciated and not on the current replacement cost.

Additional Information and Resources

Because the material covered here is considered an introduction to this topic, many complexities have been omitted. You should always consult with an accounting professional for assistance with your own specific circumstances.

No comments:

Post a Comment